Having an accident in a company vehicle is bound to happen if you’re in business for any extended length of time. It’s one of the major expenses of a professional pooper scooper company as opposed to a small startup company without proper commercial insurance. This week in Dallas, Scoop Masters experienced yet another accident with a company vehicle. Fortunately, it wasn’t the fault of the employee. However, it can still affect the insurance rates as it was a hit and run. My guess is the perpetrator didn’t carry any insurance and fled.

When an accident occurs involving a company vehicle, determining liability can be a complex issue. The outcome depends on factors such as the employee’s role, the nature of the trip, and the company’s policies. Some of the same “rules” apply with employees as they do to everyone else. The person in the back is usually at fault for not allowing enough distance between them and the vehicle in front.

Understanding Liability in Company Vehicle Accidents

- Employer Liability (Vicarious Liability): Employers may be held responsible for accidents caused by employees during work-related tasks, under the doctrine of “respondeat superior.” That’s why Scoop Masters carries commercial auto insurance.

- Employee Liability: If an employee uses a company vehicle for personal reasons without authorization, they might be personally liable for any accidents.

- Insurance Coverage: Typically, a company’s insurance policy covers accidents involving company vehicles. However, coverage details can vary, and personal auto insurance may also play a role.

- State Laws: Liability can also be influenced by state-specific laws and regulations regarding employer responsibility and insurance requirements.

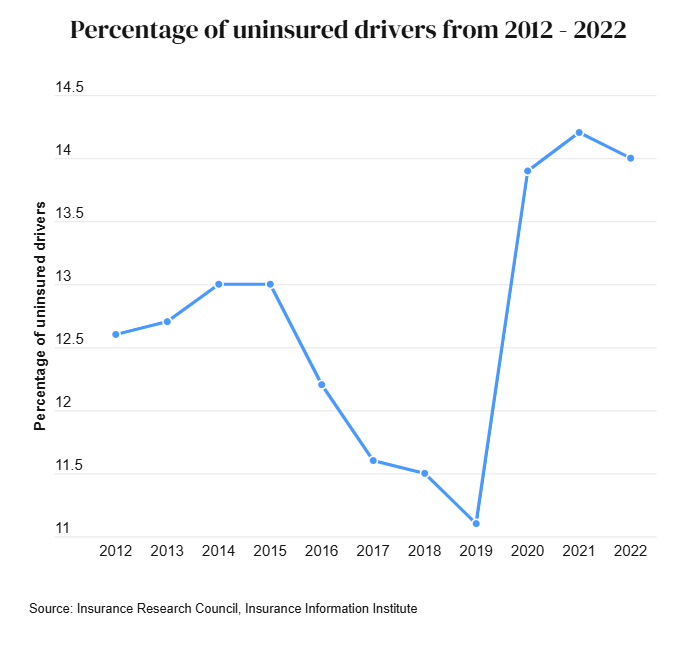

Percentage of U.S. Drivers Without Auto Insurance

In 2024, it’s estimated that around 14% of drivers in the US are uninsured. This means that about one in seven drivers are driving without insurance. In addition, the Insurance Research Council reported a rise from 11% in 2019 to 14% in 2022, with initial data for 2023 suggesting a continued upward trend. This percentage can vary by state, with some states experiencing higher rates of uninsured motorists.

My personal opinion, and it’s just my opinion: In 2019 and 2020 during the height of covid-19, many people were simply not driving and decided to cancel their insurance. By the time they started driving again, the costs were so high, that many decided to take their chances without it. Again, that’s just my personal opinion.

What to Do When Involved in a Vehicle Accident

Being involved in a vehicle accident can be stressful. It’s essential to stay calm and follow these steps to ensure safety and proper documentation:

- Check for Injuries: Assess yourself, passengers, and others involved for injuries. Get medical attention if needed.

- Ensure Safety: Move to a safe location if possible and turn on hazard lights. Take a picture of their license beforehand, if possible, just in case they decide to bolt.

- Call Authorities: Contact the police to report the accident, especially if there are injuries or significant property damage. More than likely, they will not bother if there are no injuries. Even for a hit and run.

- Exchange Information: Share and collect names, addresses, phone numbers, driver’s license numbers, license plate numbers, and insurance details.

- Document the Scene: Take photographs of the accident scene, vehicle damages, and any relevant road conditions.

- Avoid Admitting Fault: Do not admit fault at the scene; let the insurance companies and authorities determine liability.

- Notify Your Insurance Company: Report the accident to your insurer promptly, providing all necessary information.

- Consult an Attorney: If there are disputes over liability or significant damages, consider seeking legal advice.

By following these steps, you can navigate the aftermath of a vehicle accident more effectively, ensuring your rights and safety are protected.

Conclusion

Determining liability in accidents involving company vehicles requires careful consideration of employment status, the nature of the trip, and applicable insurance policies. Understanding the steps to take after an accident and being aware of the prevalence of uninsured drivers can help you be better prepared and protect your interests.

Last week makes about 7 accidents (and one vehicle fire, but that’s another story) involving a Scoop Masters vehicle from all locations. I’m not sure that’s good, bad or average. What I do know, is that it causes our insurance rates to go up regardless of who’s at fault, and that cost gets passed onto our clients as a part of doing business.

With locations in Los Angeles, Ventura, Dallas, Austin and Nashville, Scoop Masters pet waste removal helps dog owners enjoy their yard again. Since 1988, we’ve been enforcing the “no flies” zone in backyards, patios and dog runs by keeping them dog poop free. We also offer a sanitizing service to help get rid of the smell on rocks, concrete and artificial turf. Contact us for a free quote. Follow us on Facebook and Twitter/X. If your dog can poop it, we can scoop it!

Trackbacks/Pingbacks